Life Insurance’s Role: Adapting Your Coverage to Big Changes

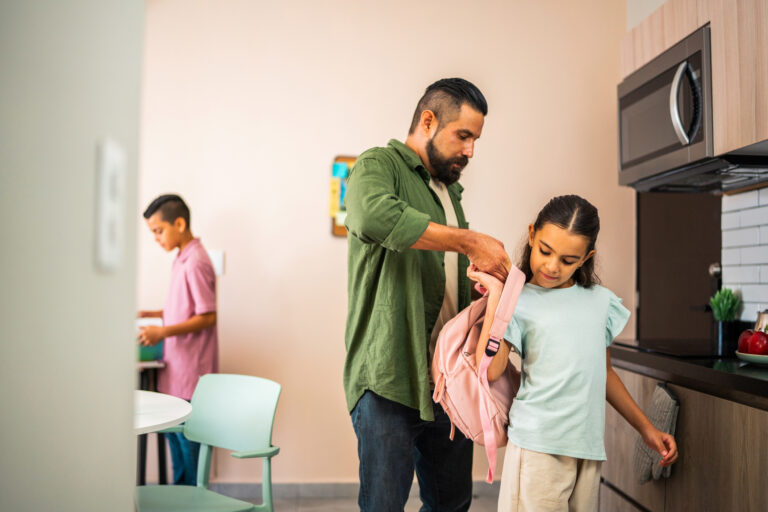

As life changes, so do your financial needs, and life insurance should match your current situation. While many people buy a policy and forget about it, your coverage should evolve with each major life event. From tying the knot to expanding your family or launching a business, staying protected means