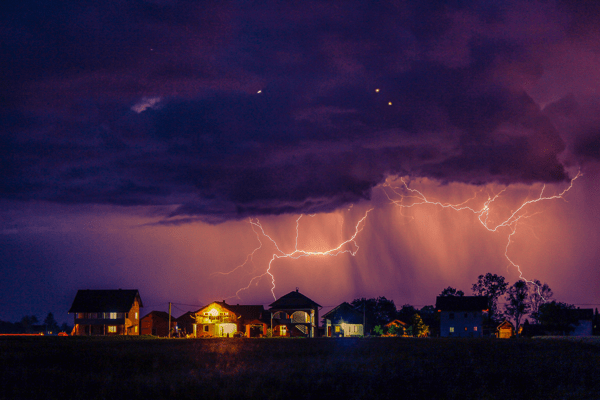

Do I Need Tornado Insurance In My Area?

According to the Insurance Information Institute (III), approximately 1,200 tornadoes touch down in the U.S. every year, with wind speeds as high as 300 mph. Peak tornado season is April through June or July. The most severe tornadoes tend to occur in the spring when they strike the Southeast, a